From the Institute For Agriculture and Trade Policy:

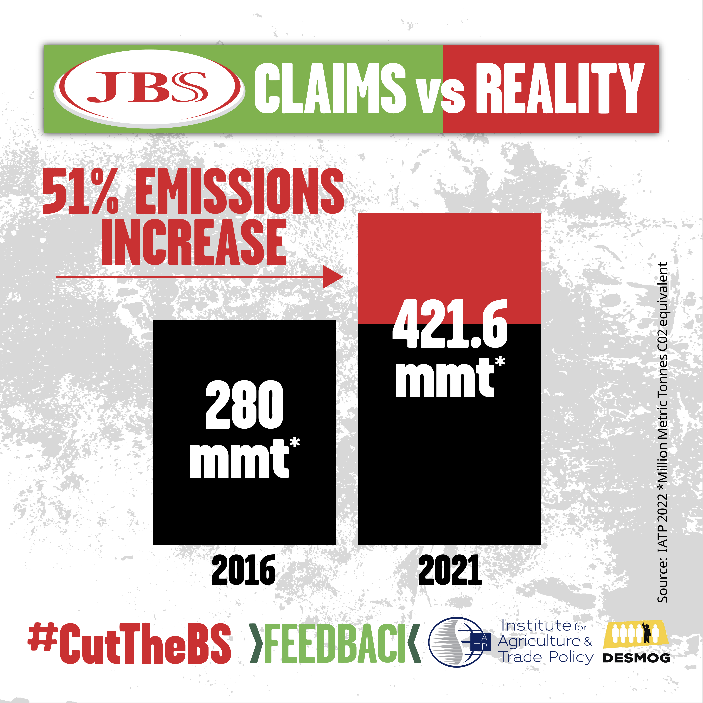

One year ago, JBS, the world’s largest meat processor, pledged to reach “net zero “emissions by 2040. According to IATP’s estimates, however, JBS’ emissions rose substantially by 51% in just five years. On the eve of JBS’ annual general meeting, we supported calls on investors and customers to divest and stop sourcing from JBS, as well as called on governments to regulate JBS and other companies and support a transition out of the destructive model of industrial livestock production.

IATP’s new emissions estimates for JBS — the world’s largest meat processor — find that the Brazil-based company increased its emissions by 51% in five years. Together with DeSmog and Feedback, IATP released the findings in our joint media briefing on the eve of JBS’s annual general meeting (AGM). One year ago, JBS pledged to reach net zero emissions by 2040, through emission reductions in their operations and by offsetting all remaining residual emissions. Instead, according to IATP’s estimates, JBS’s emissions rose substantially from 280.2 mmt in 2016 to 421.6 million metric tonnes (mmt) in 2021. The company’s unchecked global expansion has resulted in a substantial increase of animals in its supply chain: the number of cattle increased by 54%, pigs by 67% and chickens by 40%. Animals make up 90-97% of industrial livestock companies’ emissions.

Drawing from JBS reports, investor presentations and industry sources, we found that in 2021, JBS processed 26.8 million cattle, 46.7 million pigs and 4.9 billion chickens. Both the livestock numbers and the emissions are a conservative estimate given the lack of transparency in the industry regarding the number of animals slaughtered. IATP’s emissions estimates utilize the U.N. Food and Agriculture Organization’s GLEAM methodology.

Ahead of the company’s AGM in São Paulo tomorrow (April 22), IATP supports calls by Mighty Earth, Feedback and others to drop JBS, urging JBS’s investors and customers to divest and stop sourcing from the Brazil-based company. JBS’s top investors include Brazilian development bank BNDES, asset manager BlackRock, and Barclays and Santander banks. The company’s major customers in the retail sector include supermarket giants Carrefour, Costco, Tesco, Walmart and Ahold Delhaize. In the fast food sector, its customers include McDonald’s, Burger King and KFC. Mighty Earth has launched its own study, The Boys from Brazil, citing our emissions estimates.

Both the Mighty Earth report and our media briefing echo the Drop JBS campaign demands for divestment; for the Brazilian government to stop financing the company and effectively regulate deforestation and methane emissions from the livestock industry; and for full disclosure of JBS’s emissions and independent verification of its emission claims.

IATP has heavily criticized an industry favored climate metric — reduction of “emissions intensity.” Companies use this metric to tout their efficiency — measuring and reducing their emissions per kilo of meat — as opposed to reducing their total emissions. Yet even within this limited metric, JBS is moving dramatically in the opposite direction. Our new research found that in 2020, JBS pledged to make a 30% cut within 10 years to its Scope 1 and 2 emissions, which covers greenhouse gases emitted directly or indirectly by the company’s operations (limited to its processing plants and offices). Yet, JBS reported in 2021 that its emissions intensity actually increased by 30% between 2019 and 2020, according to figures it submitted to the Carbon Disclosure Project (CDP).

In January 2022, a Bloomberg investigation concluded that JBS was “one of the biggest drivers of Amazon deforestation.” The company’s base of direct cattle supplier farms in the Amazon more than doubled between 2009 and 2020, from around 7,700 to 16,900. The number of JBS slaughterhouses in the Amazon also more than doubled over this period, according to the investigation. In October 2021, Brazilian federal prosecutors concluded that JBS had purchased over 300,000 cattle from ranches with “irregularities” the previous year, including illegal deforestation in the Amazon region, and that the situation was worsening. JBS’s total deforestation footprint in six Brazilian states since 2008 has been conservatively estimated at 200,000 hectares (ha) in its direct supply chain and 1.5 million ha in its indirect supply chain.

Ahead of COP 26, IATP published a detailed exposé on JBS’s involvement in numerous environmental and financial scandals that call into question the company’s integrity in making any climate claims for the future. Our new briefing reveals that even in the six month since our publication, JBS has continued its record of frequent rule-breaking in numerous areas. In just the last few months, JBS has:

- Settled with U.S. Department of Justice for $53 million over a price-fixing scheme in beef markets (February 2022)

- Obtained court approval to settle price fixing in the poultry market for $76 million (December 2021)

- Agreed to pay $12.7 million to settle pork price-fixing charges (November 2021)

- Been fined $59,000 by the U.S. Occupational Safety and Health Administration due to a fatality at a JBS operation (October 2021)

JBS continues to make climate claims to investors, even as the company massively increases its emissions. In 2018, we estimated that JBS’s emissions were roughly half that of oil majors such as BP, Shell or ExxonMobil. Our updated emissions estimates clearly show the harm being done by empty net-zero announcements. Investors gathering at the AGM shouldn’t be fooled by this greenwash. We need public, independent and accountable systems for monitoring these companies’ emissions. Governments need to step up and regulate these companies and support a transition out of this destructive model of industrial livestock production.