An interesting article by Ann Pettifor.

The war and inflation – who is winning?

In a world of financialised globalisation, prices of food are not determined by the simplistic laws of supply and demand.

Prices are determined by a wall of money wielded by relatively few, invisible speculators and aimed at largely unregulated global grain markets.

Yesterday, the Financial Times ran an article on global food security. Editors made clear the text was not the work of FT journalists, but “partner content.” The name of the partner? Bayer AG – by their own definition “a global leader in agriculture.” The article began thus:

While the people of Ukraine face an ongoing nightmare, the Russian invasion has set in motion a global food crisis that requires our attention and immediate action. In fact, the war has knocked the global food system off its axis, risking a humanitarian disaster.

As readers will know from an earlier post, I take a different view. The global food crisis is a consequence of commodity price speculation on Wall St and the CME – not directly the Russian invasion of Ukraine. Readers may think this controversial, but bear with me, as we hear Bayer out:

Ukraine is one of the most important suppliers of wheat, corn, oils, and other essential commodities to the world. Known as the breadbasket of the world, the country has secured the food supply for parts of the Middle East and East Africa, including countries like Egypt and Lebanon whose stability is paramount for the region.

These facts – the invasion of Ukraine, and the latter’s role as “as one of the most important suppliers of wheat, corn…” were directly contradicted by Bayer AG on another platform: when announcing its Q1 earnings results – as Seeking Alpha reported in May this year – fully three months after war began:

The German conglomerate’s core EPS grew +36.3% Y/Y to €3.53. Net income (including discontinued operations) grew +57.5% to ~€3.29B. Group sales grew +18.7% Y/Y (or +14.3% on a currency and portfolio-adjusted basis, or Fx & portfolio adj.) to ~€14.64B.

“We achieved outstanding sales and earnings growth, with particularly substantial gains for our agriculture business,” said Werner Baumann, chairman of the board of management.

The company said that in Q1 group sales and earnings were not negatively impacted by Russia’s invasion of Ukraine. In total, the two countries account for ~3% of sales.

The emphases are mine. Now of course the invasion of Ukraine, and the fact that both Russia and Ukraine account for a proportion of global sales of grain had a material impact on speculators. But as Bayer AG acknowledges the share of sales is not large enough to cause the kind of food crisis the world has endured. This is because Russia produces just 11% of the world’s wheat and Ukraine produces 3%. There are plentiful supplies elsewhere to compensate for the loss of these shares in global grain markets. Which partly explains why Bayer AG were able to rake in massive gains from the deliberate inflation of food price rises.

As the UCDavis academic, Aaron Smith asks:

What if the world has lost access to the 55 million metric tons of wheat and 30 million metric tons of corn exported from Ukraine and Russia? These quantities represent 7.3% of global wheat and 2.6% global corn production.

And as he also confirms, regardless of that small share

Wheat futures prices have increased since the day before the invasion (February 23)

Futures prices are guesses – speculation on the future direction of prices. They are not the consequence of a fall of 3% in the supply of grain from Ukraine.

The second, and perhaps the most awkward fact is this: grain prices have now fallen below the pre-invasion of Ukraine levels.

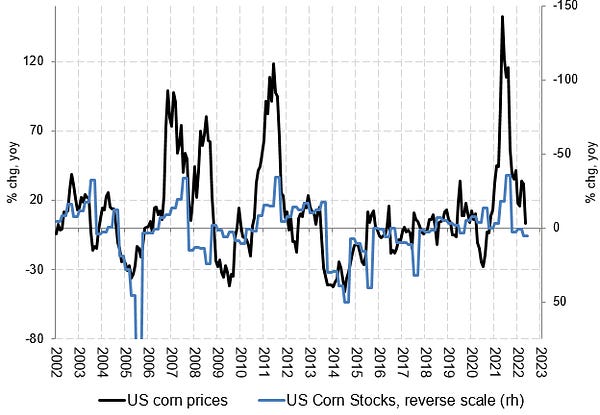

As @takis2910 noted…the rise in corn inventories is a little odd, given panic over the inflation of food prices.

The awkward fact is these prices have fallen even though Russia’s invasion of Ukraine has not come to an end. And despite Turkey’s admirable diplomatic efforts, and foreign Minister Lavrov’s protestations, Russia had still not released ships bearing grain from the vast “bread basket” of Ukraine at the time this goes to press. In other words, there has been no increase in the supply of wheat from that region.

So why have prices fallen when the war is still ongoing, and Ukrainian farmers are without the support promised by many western countries and corporations? Above all: why have prices fallen when there has been no apparent increase in supply?

Y’all know the answer.

In a world of financialised globalisation, prices of food, vital to the very survival of human beings on all the world’s continents – are not determined by the simplistic laws of supply and demand.

Prices are determined by a wall of money wielded by relatively few, invisible speculators and aimed at largely unregulated global grain markets.

Central bankers & inflation: mimicking Volcker’s mistakes

Central bankers have scored several massive ‘own goals’ by using monetary policy to contract economic activity, and thereby, they argue, reducing inflation. It does not occur to them to cool inflation by regulating and disciplining speculators – whose activities have triggered global inflation. Instead monetary policy is used to discipline nations (like Greece and Italy). These decisions in turn, are triggering sovereign debt crises and recession – worldwide. Just as in their eagerness to discipline workers demanding higher wages to cope with inflation, central bankers punish not just workers, but also consumers worldwide.

But the rationale for monetary tightening was that it would bring down inflation. Hence the deceptions about the impact on food markets and inflation by the war in Ukraine. Lies both the United Nations and Bayer AG are happy to repeat in this article. (And the FT is not off the hook here – willing to take the equivalent of thirty pieces of silver to aid this cover-up.)

But just as happened under the influence of Paul Volcker – when the economy was not rescued by monetary tightening but instead was trashed by monetary tightening at a time of weakness. Just as in the 1970s, the damage was inflicted first by lax regulation and loose monetary policy, and then by the sudden and dramatic tightening of policy.

So why are food prices falling?

To understand the fall in the global market for grain prices, consider this: speculators recognise correctly that monetary tightening means a global recession/crash is on the way. And there is nothing more effective in trashing grain and energy prices than global economic failure. Millions will be impoverished – and less food and energy will be consumed – as sure as night follows day.

So in the near future, the global economy will slump (a process that has already begun) and demand really will fall – and so will prices. Wall St speculators are one step ahead of central bankers – and are predicting the coming recession.

When this happens, we will all suffer. But few of us will be aware of the role of speculation. Politicians do not care. And nothing will have been done about speculation in global food markets on which human survival depends.